Foreign Funds Target Greek Tourism – Growth or Loss of Greek Identity?

In recent years, Greek tourism has been at the center of an investment “spring,” fueled largely by the entry of international investment funds. Spanish, American, and Asian funds are investing billions in resorts, all-inclusive complexes, and landmark hotels, from Santorini to Halkidiki.

This trend has played a decisive role in upgrading the hotel sector, introducing international brands, high operating standards, and sustainable development practices. However, some warn of the risk of “de-Hellenization” of the industry and the short-term nature of many of these investments.

Major Moves by Foreign Funds

Azora: From Rhodes to the Heart of Athens

Spanish fund Azora made one of the most notable moves of the year by acquiring 50.1% of Donkey Hotels. The deal places iconic hotels such as the Intercontinental Athens, Semiramis, Periscope, New Hotel, and NOUS in Santorini under its control. The investment plan, worth over €60 million, includes a complete renovation of the Intercontinental. This comes after the acquisition of the Sheraton Rhodes, confirming Azora’s strategy of targeting high-value properties.

HIG Capital: Broad Presence in the Islands

American firm HIG has invested around €300 million in Greek tourism. It owns properties in Rhodes, Crete, and Corfu, including the Helea and Elissa in Rhodes and the Alkyna in Corfu. The acquisition of the Kypriotis Group’s five hotels in Kos added 1,522 rooms and two conference centers with a capacity of 7,500 delegates to its portfolio. HIG is also investing in large-scale projects, such as a hotel in Althea with a budget exceeding €80 million.

Hines and Henderson Park: From the Grand Hyatt to Crete

Hines entered the Greek market by acquiring the former Ledra Marriott (now Grand Hyatt Athens) and has also bought hotels from the Kefalogiannis and Mamidakis groups, which will operate under international brands such as Intercontinental, Wyndham, and MGallery. In partnership with Henderson Park, they developed the “Apollo Hills” project in Voula, worth €200 million.

Blackstone – Hotel Investment Partners (HIP): Strategic Expansion

Blackstone, through HIP, now owns ten hotels in Greece with a total capacity of 2,641 rooms, located in Athens, Crete, Corfu, Zakynthos, Rhodes, and Halkidiki. It has invested nearly €100 million in renovations, focusing on sustainable operations, with five properties already BREEAM certified.

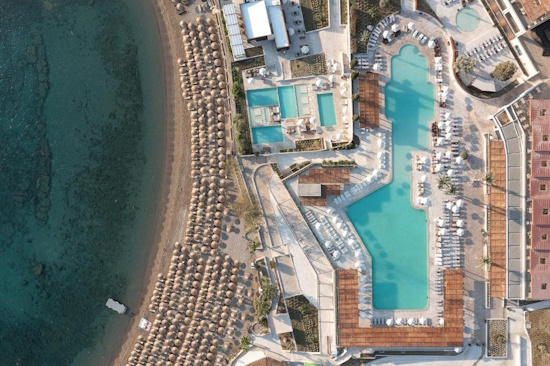

GIC – Sani/Ikos: The Largest Sovereign Fund Investment

Singapore’s sovereign wealth fund, GIC, acquired the stakes held by major international investors in Sani/Ikos, in a deal valuing the company at around €2 billion. The aim is to strengthen a large-scale international investment plan, with expansions and upgrades in top destinations.

Benefits and Upgrades

The presence of these funds has multiplied investments in the sector, driving the renovation of old properties, upgrading infrastructure, and placing Greece firmly on the map of international hotel brands. Their entry brings know-how, modern management practices, and strict operational standards, boosting the competitiveness of the Greek tourism product. Moreover, the emphasis on sustainability and infrastructure certification adds value to Greece as a high-quality destination.

Concerns and Challenges

Despite the positives, many Greek entrepreneurs express concerns about the future. The massive influx of foreign capital raises fears of a “de-Hellenization” of the tourism industry, where decisions are made abroad and local business involvement diminishes.

Another issue is the investment horizon. Most funds have a limited investment cycle—often between 5 and 10 years—aiming to exit once the desired returns are achieved. This means major tourist properties may change hands again in the future, with unpredictable effects on the local market and employment.

The Road Ahead

Greece now stands at the center of the global investment agenda for tourism. The challenge moving forward is twofold: to continue upgrading and modernizing the hotel sector while ensuring that growth retains a meaningful Greek presence in terms of ownership and management.

Striking the right balance between attracting foreign capital and preserving national business participation will determine whether the “golden decade” of tourism investments leaves behind a stable and sustainable ecosystem—or a market dependent on the decisions of international funds with short-term horizons.

Source: tornosnews.gr